USDA loan refinance: Cut Down Your Housing Expenses with No Stress Today.

USDA loan refinance: Cut Down Your Housing Expenses with No Stress Today.

Blog Article

Attain Reduced Settlements: Necessary Insights on Finance Refinance Options

Financing refinancing offers a calculated chance for house owners looking for to reduce their month-to-month repayments and general financial obligations. By taking a look at numerous re-finance alternatives, such as rate-and-term and cash-out refinancing, people can tailor solutions that straighten with their certain monetary scenarios. However, the choice to re-finance involves mindful consideration of market conditions, individual funds, and loan provider comparisons to absolutely maximize prospective advantages. As we check out these aspects, one might ask yourself: what essential elements could either improve or undermine the refinancing process?

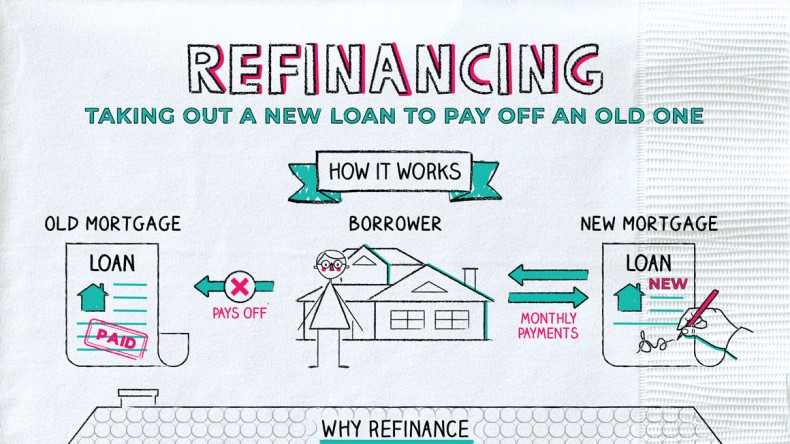

Comprehending Finance Refinancing

Loan refinancing is a financial technique that enables consumers to replace their existing car loans with brand-new ones, commonly to safeguard more favorable terms. This process can lead to lower rates of interest, minimized month-to-month payments, or a various financing period that much better lines up with the debtor's monetary goals.

The primary inspiration behind refinancing is to improve financial adaptability. By examining present market conditions, customers may locate that rate of interest have reduced because their original loan was taken out, which can lead to significant savings with time. In addition, refinancing can supply chances to consolidate financial obligation, changing several high-interest obligations right into a solitary manageable payment.

It is essential to think about the associated costs of refinancing, such as shutting fees and other expenditures, which can balance out prospective cost savings. Examining one's economic circumstance and long-lasting purposes is necessary before devoting to refinancing.

Kinds Of Refinance Options

Refinancing offers a number of options customized to fulfill varied monetary demands and objectives. One of the most common kinds include rate-and-term refinancing, cash-out refinancing, and simplify refinancing.

Rate-and-term refinancing permits borrowers to readjust the rate of interest, financing term, or both, which can cause lower regular monthly settlements or decreased overall interest expenses. This choice is often gone after when market rates go down, making it an appealing choice for those seeking to conserve on passion.

Cash-out refinancing makes it possible for property owners to access the equity in their building by obtaining greater than the existing home mortgage equilibrium. The distinction is taken as money, giving funds for major costs such as home remodellings or financial debt consolidation. This alternative boosts the overall lending quantity and may impact long-term financial security.

Each of these refinancing types uses unique benefits and factors to consider, making it this post important for debtors to review their specific economic circumstances and goals before proceeding.

Benefits of Refinancing

Refinancing can supply a number of monetary benefits, making it an attractive alternative for several. If market prices have actually lowered since the initial home loan was protected, house owners may refinance to acquire a reduced price, which can lead to decreased regular monthly settlements and substantial cost savings over the lending's term.

In addition, refinancing can help house owners gain access to equity in their home. By going with a cash-out re-finance, they can convert a part of their home equity right into cash money, which can be utilized for home renovations, financial obligation loan consolidation, or other economic demands.

One more benefit is the opportunity to transform the financing terms. House owners can switch over from an adjustable-rate mortgage (ARM) to a fixed-rate home mortgage for higher security, or shorten the lending term to repay the home mortgage faster and save money on interest costs.

Elements to Think About

Before choosing to re-finance a home mortgage, house owners must very carefully review numerous essential variables that can considerably affect their economic situation. Initially, the current rates of interest in the marketplace need to be examined; refinancing is commonly beneficial when prices are less than the existing home loan rate. Additionally, it is vital to take into consideration the remaining term of the current home mortgage, as expanding the term might bring about paying even more rate of additional hints interest over time, regardless of reduced monthly settlements.

Last but not least, house owners must analyze their lasting monetary objectives. If planning to relocate the near future, refinancing might not be the very best alternative (USDA loan refinance). By very carefully thinking about these factors, homeowners can make enlightened choices that align with their economic goals and overall security

Steps to Refinance Your Lending

As soon as house owners have evaluated the crucial elements influencing their decision to re-finance, they can proceed with the essential steps to finish the procedure. The initial step is to determine the type of refinance that best fits their financial objectives, whether it be a rate-and-term refinance or a cash-out re-finance.

Next, homeowners must collect all appropriate economic documents, including revenue statements, tax obligation returns, and information regarding existing financial debts. This documents will be crucial when applying for a brand-new lending.

Once an ideal lender is selected, house owners can submit their application. The lending institution will perform an extensive review, which might consist of an appraisal of the residential property.

After authorization, homeowners will get a Closing Disclosure detailing the terms of the brand-new car loan. Ultimately, upon closing, the new funding will certainly go to the website settle the existing home mortgage, and house owners can begin delighting in the benefits of their refinanced funding, consisting of reduced regular monthly repayments or accessibility to money.

Verdict

To conclude, finance refinancing presents a beneficial possibility for house owners to attain reduced payments and relieve economic anxiety. By comprehending different re-finance options, such as rate-and-term, cash-out, and streamline refinancing, individuals can make educated decisions customized to their economic scenarios. Cautious consideration of market conditions and lender contrasts better enhances the capacity for long-lasting savings. Ultimately, strategic refinancing can substantially enhance financial security and give higher flexibility in managing expenditures.

Report this page